How investors can prepare for low interest rates: It’s ‘like a haircut,’ adviser says

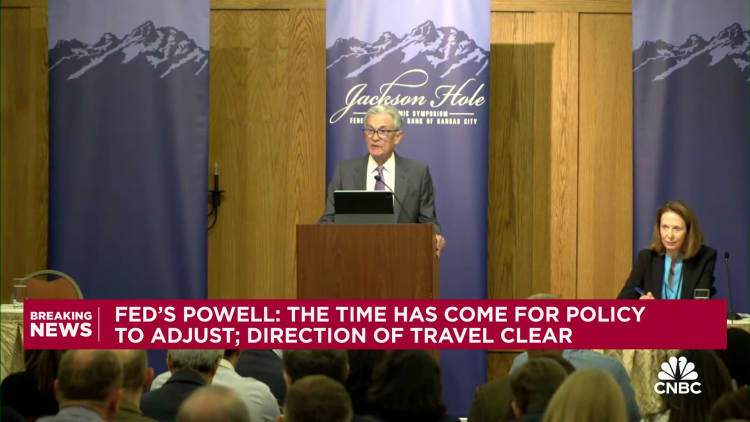

Federal Reserve Chairman Jerome Powell.

Andrew Harnik | Getty Images

Federal Reserve Chairman Jerome Powell on Friday gave the clearest indication yet that the central bank may begin cutting interest rates, which are currently at their highest level in two decades.

If the rate cut comes in September, as experts expect, it will be the first time authorities have lowered rates in more than four years, when they dropped them to zero at the start of the Covid-19 pandemic. 19.

Investors may be wondering what to do during this policy shift.

Those who are already diversified may not need to do much now, according to financial advisors on CNBC’s Advisory Council.

“For a lot of people, this is welcome news, but it doesn’t mean we’re making big changes,” said Winnie Sun, co-founder and chief executive of Sun Group Wealth Partners, based in Irvine, California.

“It’s like a haircut: We’re doing little trims here and there,” he said.

Many long-term investors may not need to do anything at all — such as those who hold most or all of their assets in a mutual fund through their 401(k) plan, for example. consultants said.

Such funds are overseen by professional asset managers who are equipped to make the necessary tweaks for you.

“They do it behind the scenes for you,” said Lee Baker, a certified financial planner and founder of Claris Financial Advisors, based in Atlanta.

More from Personal Finance:

Why remote work has staying power

This RMD plan can help avoid IRS penalties

Some colleges now cost as much as $100,000 a year

That said, there are other changes that many investors may consider.

In particular, these tweaks will apply to cash and fixed income, and possibly to a variety of stocks in a person’s portfolio, advisers said.

Low rates are positive for stocks

In his keynote speech on Friday at the Fed’s annual meeting in Jackson Hole, Wyoming, Powell said “the time has come” for interest rate policy to be adjusted.

That announcement comes as inflation has fallen sharply from a pandemic-era peak in mid-2022. And the labor market, while still healthy, has shown signs of weakness. Lower rates could take some of the pressure off the US economy.

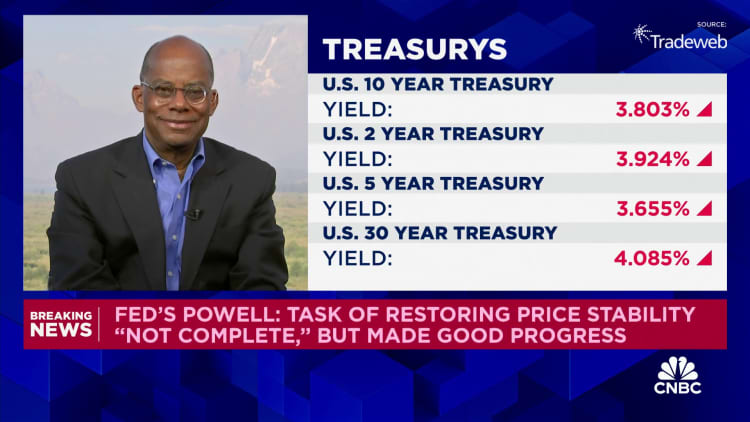

The Fed will likely choose between a 0.25 percent and 0.50 percent rate cut at its next policy meeting in September, Stephen Brown, deputy chief economist for North America at Capital Economics wrote in a note Friday.

Low interest rates are “generally good for stocks,” said Marguerita Cheng, CFP and managing director of Blue Ocean Global Wealth, based in Gaithersburg, Maryland. Businesses can feel more comfortable growing if the cost of borrowing is low, for example, he said.

But the uncertainty surrounding the number of future rate cuts, as well as their size and pace, means that investors should not make too many changes to their portfolios. as a tough response to Powell’s announcement, advisers said.

“Things can change,” Sun said.

Notably, Powell did not commit to lowering rates, saying the target is based on “incoming data, an ongoing outlook, and a risk assessment.”

Definitions of money, bonds and stocks

The drop in interest rates generally means investors can expect lower returns on their “safe” capital, advisers said.

This would include relatively low-risk businesses, such as savings accounts, money market funds or certificates of deposit, and short-term bond funds.

High interest rates have made it possible for investors to enjoy very high returns on these low-risk institutions.

It’s like a haircut: We’re doing little trims here and there.

Winnie Sun

co-founder and managing director of Sun Group Wealth Partners

However, such payments are expected to fall along with falling interest rates, consultants said. They generally recommend locking in the highest cash-guaranteed rates while they are available.

“It’s probably a good time for people considering buying CDs from a bank to lock in higher rates for the next 12 months,” said Ted Jenkin, CFP and CEO and founder of Atlanta-based oXYGen Financial.

“A year from now you probably won’t be able to renew at the same rates,” he said.

Others may wish to park more cash — amounts that investors don’t need for short-term use — in higher-paying fixed-income investments like long-term bonds, said Carolyn McClanahan, CFP and founder of Life Planning Partners in Jacksonville, Florida.

“We’re very committed to making sure customers understand the interest rate risk they’re taking on by holding onto cash,” he said. “Too many people don’t think about it.”

“They will cry in six months when interest rates are so low,” he said.

Bond duration is a measure of the bond’s sensitivity to changes in interest rates. The term is expressed in years, and the coupon notes, the maturity period and the yield paid during that period.

Short-term bonds – those with maturities of a few years or less – typically pay lower yields but carry less risk.

Traders may need to increase their time (and risk) to keep the yield in the same ballpark as it was two years ago, the consultants said. A time frame of five to 10 years is probably right for most investors right now, Sun said.

However, advisors do not recommend reducing stock-bond allocations.

But investors may wish to make more future contributions to a variety of stocks, Sun said.

For example, stocks of utilities and home improvement companies tend to do better when interest rates fall, he said.

Asset classes such as real estate investment trusts, preferred stocks and small-cap stocks also tend to do well in such an environment, Jenkin said.

#investors #prepare #interest #rates #haircut #adviser